And you’ll must be aware of the risks and you will exchange charges that can sound right with various alternatives actions. Although agents provides got rid of costs for change brings or replace-traded fund (ETFs), this type of continue to exist to have alternatives. The profit about this trading is the strike rate shorter the brand new https://clubxbit.com/en/ market price, as well as expenditures—the fresh superior and you may people brokerage commission to put the brand new orders. The outcome will be increased by the amount of solution deals purchased, up coming increased by the a hundred—and when per package represents a hundred shares. For each and every choices bargain constantly means 100 shares of the root investment.

For a portion of the cost, your effectively handle one hundred offers (or long lasting bargain stipulates). Put differently, you gain the efficacy of leverage, in return for the newest superior. An investor has one hundred shares of a particular stock, which is exchange during the $40 for every express.

Earnings is also generated thanks to writing (which is, selling) options. Following, in case your buyer never ever knowledge the option, mcdougal strolls away with that premium. Put choices boost in worth if underlying assets miss inside the really worth. Thus puts are of help to have hedging, securing the buyer’s collection.

VI. Knowledge Choice Greeks

Regarding valuing option deals, it’s generally everything about choosing the options out of upcoming speed incidents. The much more likely something is always to occur, the larger a choice you to earnings of one experience create getting. Such as, a visit well worth rises while the stock (underlying) rises. Lower than it scenario, the value of the possibility increases by the $0.0614 so you can $step 1.9514, recognizing a profit away from $six.14. Observe that for an excellent delta basic profile, by which the new investor got in addition to marketed forty two shares out of XYZ stock since the a hedge, the online losings under the exact same scenario would be ($15.86).

This informative article raises you to definitely possibilities change to give a fundamental knowledge since you proceed on the trade education. Like all financing possibilities you make, you should have a clear thought of that which you desire to to do prior to change possibilities. As the termination go out passes, the possibility sometimes will get meaningless or perhaps is worked out if it’s in the the bucks. To date, you need to be more always choices change currently. We’ve secure a lot of the earliest foundations from options trade. This is an excellent solution to start with if you’re also starting off having a small account because it allows you to manage high-cost stocks with minimal financing.

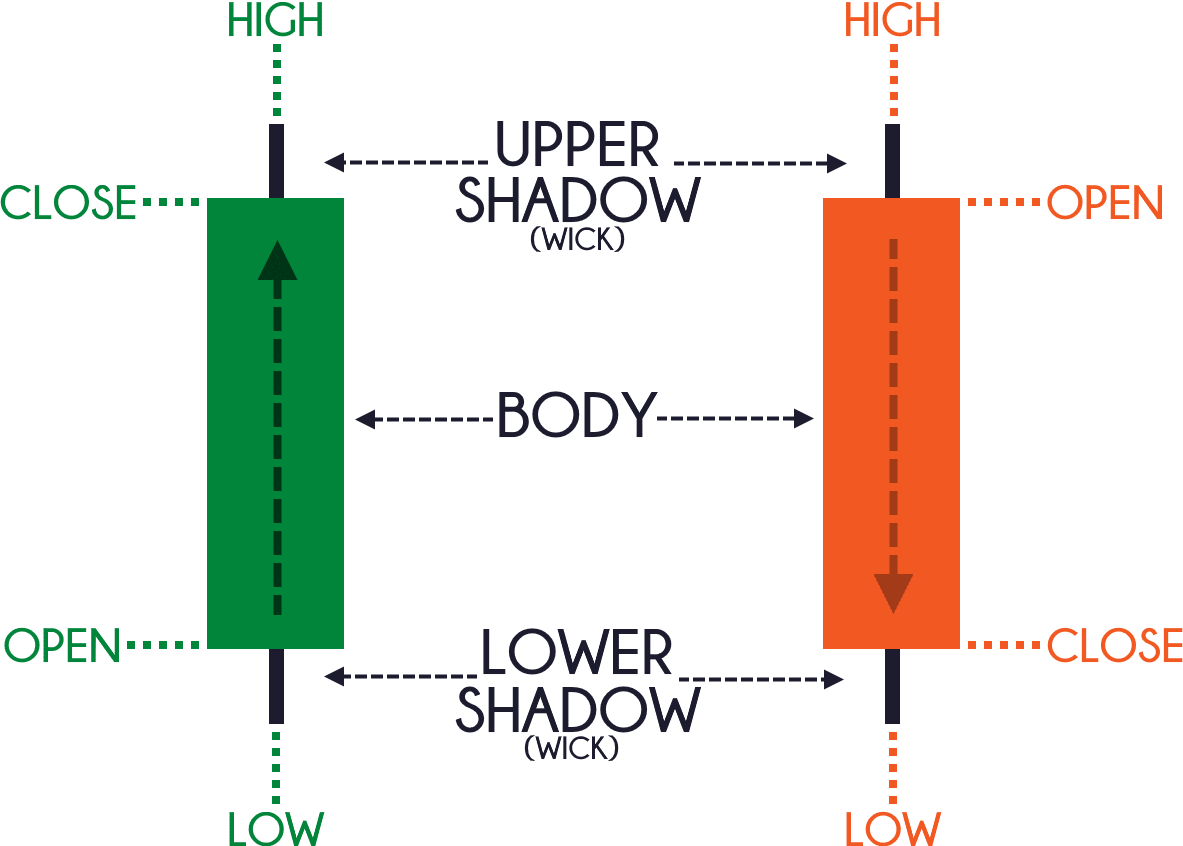

Simple tips to understand a stock option quote

So it encourages these to set a stop losses order of $40, meaning that the position often automatically getting offered should your inventory rate are at the fresh stop price, leading to the fresh end losses. The theory at the rear of these types of sales would be to limitation loss in the enjoy that the inventory price drops abruptly. The secret to this strategy would be to put the fresh avoid loss above the hit price however, below the most recent rate.

Very offers is actually free, however, while the we’ve mentioned, you have got to get an alternative. You do not get they back, even although you never use (i.e., exercise) the choice. So, ensure that you basis the brand new advanced to your considering winnings and you may losses to the alternatives. Now, let’s change this idea for the stock-exchange by imagining one to Red-colored Pizza pie Organization’s inventory is actually exchanged in the industry. A red Pizza Co December 50 name alternative would give you the legal right to pick one hundred shares of your organization’s stock to have $50 for each display to your otherwise before the call’s December termination. Very, when you buy a call option, such, you’lso are in hopes the purchase price usually increase, as you feel the to find the stock in the straight down struck speed.

- This is when the new go back-magnifying strength from options comes into play, and why choices are thought a form of control.

- These tools allow you to see just what a swap might look such, and you can photo the chance and you may award based on how day, volatility, and you can changes in the root asset’s rate could affect a keen option’s worth.

- However is generally allowed to perform a plastic material position having fun with alternatives.

- You ought to predict both field guidance and also the alternative’s termination date.

Time rust speeds up because the expiration date becomes better, so it’s vital that you think time when making positions. For those who’re already a lengthy-term trader that have extreme collection, shielded calls get prove to be a useful possibilities trading means. They selections from 0 to 1 to possess call alternatives and you may -1 to help you 0 to possess lay alternatives.

Although not, vendors have a tendency to deal with higher risk than just people, particularly if considering calls. Buyers out of calls just stand to get rid of the fresh superior, when you are writers deal with unlimited risk. Both features a termination day, the date by which the newest proprietor need do it the newest alternative.

Again, the customer paid a small premium for the right to sell inventory to possess a high price than the currently well worth for the market. From the seller’s position, you would have the superior out of $3 for each and every share, regardless of the customer’s choice to exercise the option. Whenever they create exercise it, you’d be obligated to promote the underlying protection at the strike cost of $fifty per show, in spite of the boost in inventory rates. These are choices deals which have termination schedules you to definitely history more a good year and will last as long as the three years.

Leader is actually fresh technical and may also provide incorrect or improper answers. Efficiency from Leader really should not be construed because the financing research or advice, and should not act as the basis for your financing decision. All Leader production is offered “as is.” Social can make zero representations or warranties depending on the reliability, completeness, quality, timeliness, or any other trait of these productivity. Excite individually look at and you will make certain the precision of any including efficiency for your own personal explore instance. “A traditional buyer are able to use choices to hedge a huge position,” says Robert Ross, an elder collateral analyst at the Mauldin Business economics.

The most cash try $cuatro for every display,elizabeth while the limit funds is limited to this difference. In-the-money options are higher priced than just out-of-the-money options because they features inherent really worth. Be prepared to risk a hundred or so bucks for every exchange, however, so long as you keep the risk for each trading to in the dos% of the overall membership worth, it is a lift to know and practice. The new inherent worth of an option is only the value one will be understood should your solution have been instantly resolved. But with options, you’ll be able to turbocharge the profile output by to 36%, or even 60% a-year!

That’s as to the reasons it’s crucial that you understand the risks your’re powering for those prospective perks, therefore’ll need choose yourself whether trading choices is an activity for you to do. One which just put your trading, you have to know what you need to exchange, and can wanted a lot of functions. You’ll need to comprehend the business you’lso are thinking about exchange choices in the, to make a smart decision. From that point, you may make an option approach that meets your standard. Gamma suggests simply how much the brand new Delta vary for each $step one way from the inventory price.

Vega (V) is short for the pace away from alter between a keen option’s really worth as well as the hidden asset’s IV. Vega indicates the quantity an enthusiastic option’s rate alter considering a 1% change in IV. Including, an option that have a vega out of 0.10 indicates the brand new option’s really worth is anticipated to alter because of the ten dollars in case your IV transform from the 1%. Small phone calls and brief puts, concurrently, features confident Theta.